Introduction:

When a borrower takes a loan from a bank or NBFC, the repayment of the loan is done mainly in specific monthly instalments known as EMIs or equated monthly instalments.

Let us consider an example of shopping done using Credit card EMI

- The customer places an order on the e-commerce website and selects the Credit card EMI option for payment.

- The payment gateway validates the request by checking the available credit limit of the particular card.

- After this, the issuing bank checks the eligibility of the customer and based on certain checks accepts the EMI conversion request or rejects it.

- In case of rejection, the EMI transaction gets converted to a normal Credit Card transaction. The customer can either pay the amount in full or apply for order cancellation within a defined TAT.

- If the customer applies for cancellation then no charges are deducted for EMI, and the whole amount (if deducted) is credited back to the customers’ card.

- If the EMI is approved by the bank, but the customer cancels/ returns the items purchased on EMI due to some issue, then the customer can apply for EMI cancellation.

- In this case, the service provider facilitates the refund for and on behalf of the seller as per the relevant refund policy.

Problem Scope:

The complexity of the process is very high since the data required to make reversal vouchers for cancelled EMI flows from different databases. Since the files are prepared manually, the values may not be accurate and this can lead to customer dissatisfaction. To eliminate this error, the user must validate the files gathered from all sources and perform the checks & calculations thoroughly by following a maker checker model which in turn consumes a lot of time & manual efforts.

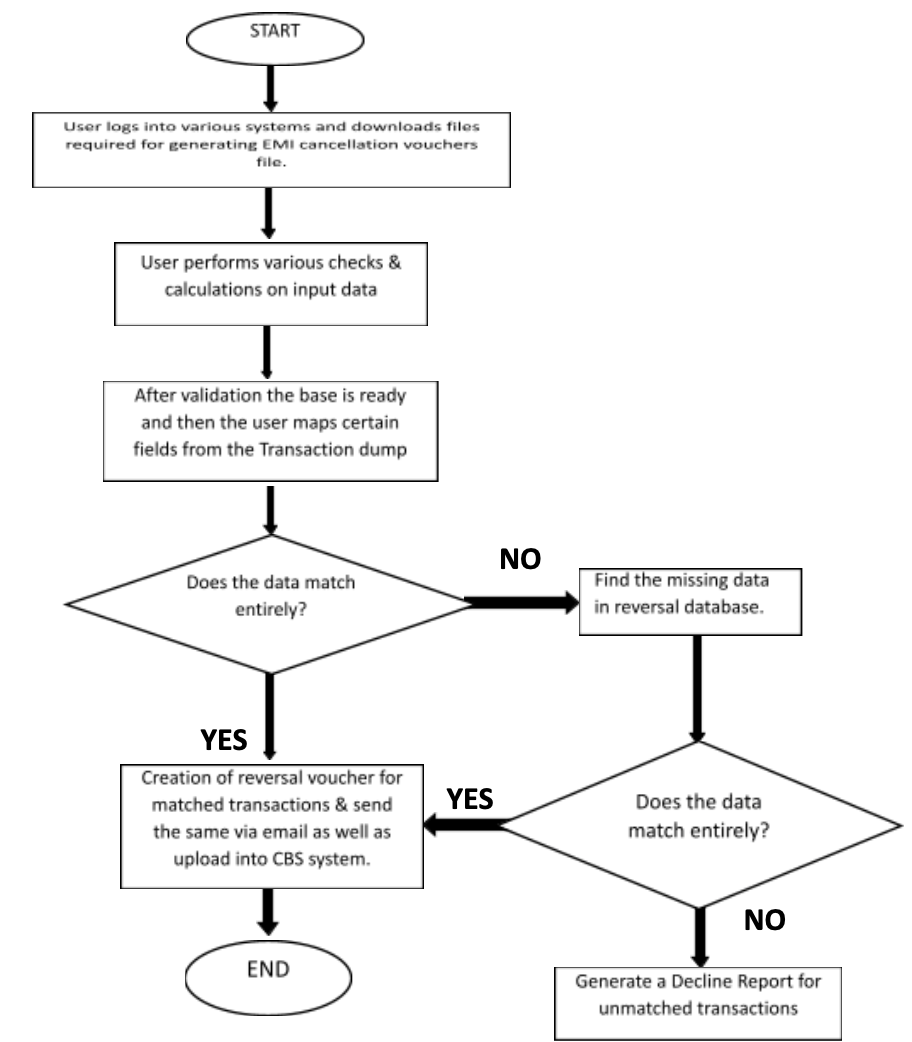

Before SheetKraft:

The operations team member used to log in to multiple banking systems to extract transaction dump & customer’s EMI data. The downloaded file consists of thousands of line items which makes the file size huge & due to this the calculation & report generation becomes very time-consuming. The entire activity was being done manually by 2 members of the operations team following the maker checker model. The entire process was highly error-prone and used to take around 4-5 hours daily

Before SheetKraft Flow-chart:

After SheetKraft:

The business team approached our expert automation team to solve the problems in the manual process and get it automated using SheetKraft. Our team reviewed the data and the working file of the business team and designed a process flow with no human intervention. Instead of reading data from .txt and .xlsx files, we integrated with the Transaction & Customer databases directly so that process can be automated by fetching the data from the database without having the user upload the files manually.

After automating with SheetKraft

- SheetKraft directly fetches the data from databases & static data from commonly shared folders without human intervention.

- The process is scheduled to run automatically on a daily basis at a pre-defined time as required by the business team.

- All the checks and calculations are defined and calculated by SheetKraft and after successful completion of the process, the business users receive a notification regarding the process completion and the EMI reversal vouchers via an automated mail.

- There is no need for a maker and checker model as the logic is pre-defined as per business requirements and this, in turn, saves effort & time.

Impact:

Earlier, the file was generated manually by downloading files from various systems and performing checks and calculations. So, the chances of error were quite high as well as it was time-consuming. To perform this activity, the business team followed the checker and maker model, but after automating with SheetKraft there is no need for a maker and checker. The output is generated automatically and sent via e-mail to all stakeholders. The entire process when done manually by the business team used to take approximately 3-4 hours per day. But after automating with SheetKraft, the entire end to end process takes only 8-10 minutes.

Book A Demo